capital gains tax news canada

The taxable portion of the capital gain is added to all of your other taxable income. Remember the deadline is the 18th this year not the 15th because the 18th is a Monday.

Canada Crypto Tax The Ultimate 2022 Guide Koinly

In Canada 50 of the value of any capital gains is taxable.

. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household. History and Potential Reforms. Investors pay Canadian capital gains tax on 50 of the capital gain amount.

This means that if you earn 1000 in capital gains and you are in the highest tax bracket in say Ontario 5353 you will pay 26765 in Canadian capital gains tax on the 1000 in gains. Guidance on affidavits and valuations Bill C-208 As of June 2021 changes to the Income Tax Act have altered the tax treatment of family transfers of shares in a qualified small business corporation and shares of the capital stock of a family farm or fishing corporation. The capital gains tax rate in Ontario for the highest income bracket is 2676.

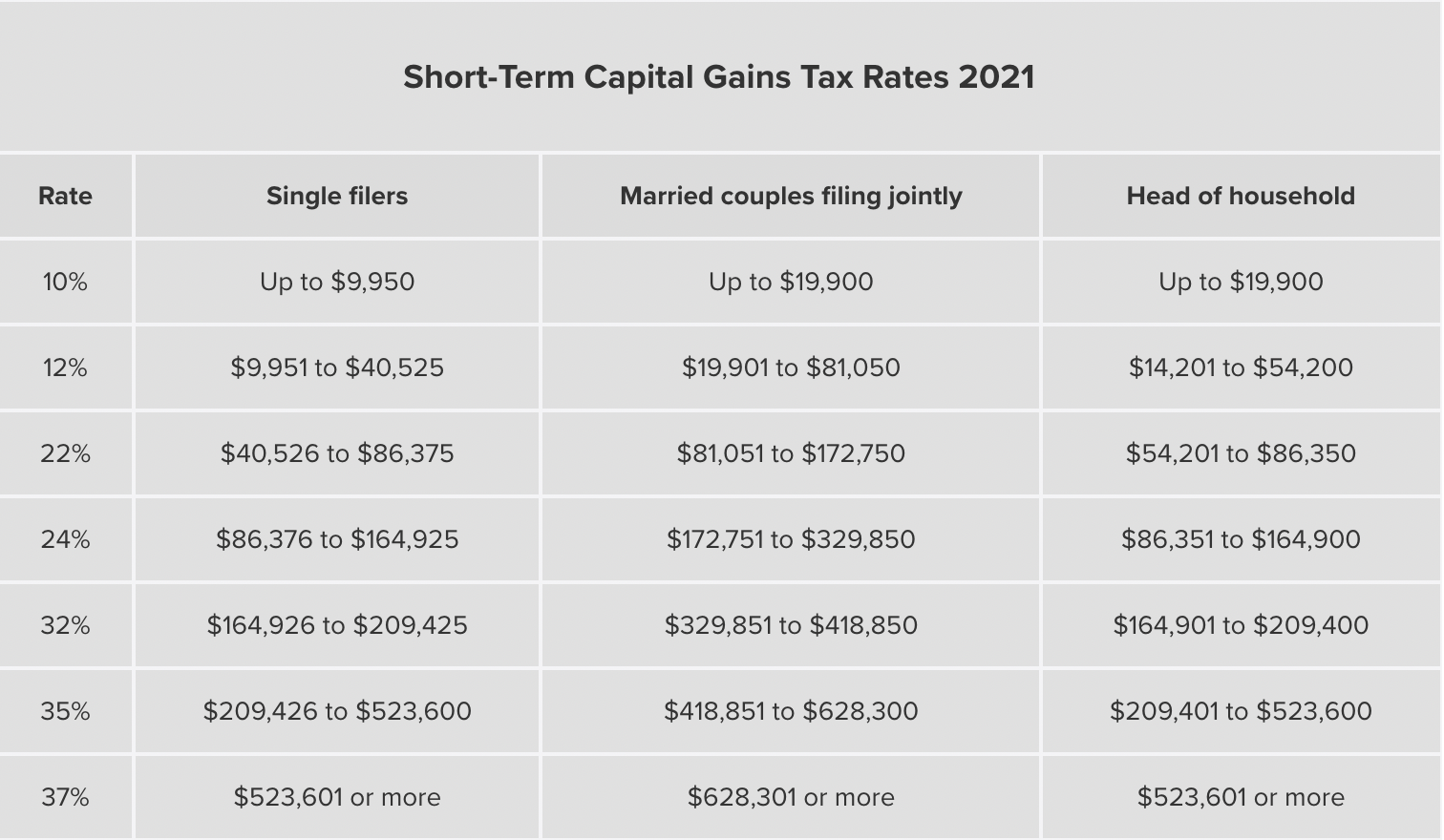

The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. If Trudeau doesnt win hes going to run. Your total income will determine the tax bracket marginal rate.

In our example A would have 100 of capital gain or 50 of taxable capital gains. Because A has paid taxes on the accrued gains the Estate acquires the shares with an increase to the cost-base up to the amount of tax paid. The new government will then have total access to records and what he has donemy guess hell.

Claims of a capital gains tax on home sales CTV News. Youve got just under two weeks left to file your taxes. Issues a verdict on.

Youll be taxed on approximately 25000 50 of the capital. Lets talk more about this with Kim Dula CPA and managing partner at Friedman LLP. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000.

Likewise because the gain has been paid for the Estate would acquire the shares with an ACB of 100. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. None of the plans put forward by Canadas main parties suggest lifting the capital gains exemption for principal residences with the exception of.

FEDERAL ELECTION 2021 Fact check. In this article we outline the history of capital gains taxation in Canada describe some of the key features of the current system and comment on potential reforms. Capital gains tax on home sales a risky proposal experts say - National Globalnewsca.

Investors pay Canadian capital gains tax on 50 of the capital gain amount. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. NDPs proto-platform calls for levying.

Its important to keep some things in mind here to avoid surprises on your tax bill. Multiply 5000 by the tax rate listed according to your annual income minus any. If you sell an investment at a higher price than you paid youll have to add 50 of the capital gains to your income.

Checks a specific statement or set of statements asserted as fact. This means that if you earn 1000 in capital gains and you are in the highest tax bracket in say Ontario 5353 you will pay 26765 in Canadian capital gains tax on the 1000 in gains. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

The province will raise the rebate on the education tax on residential and farm property to 375 this year and 50 next year. This means that if youve made 5000 in capital gains 2500 of those earnings need to be added to your total taxable income. Because you only include onehalf of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 half of 1000000.

But if were talking about a 25 increase in the capital gains tax Id say sell now while you have the chance. For more information see What is the capital gains deduction limit. Read all the latest news on Capital Gains Tax.

Capital gains tax rates are dependent on the province in which you live since provincial tax brackets vary. Lets go back to the example of the cottage purchased for 200000 and sold for 250000 generating a capital gain of 50000. One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an equivalent fair market.

When investors in Canada sell capital property for more than they paid for it Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. Capital Gains Taxation in Canada. Protecting what he has taken from Canada.

There are several capital gains tax exemptions to be aware. After income taxes and the inflation tax Investor A ends up with a 77-per-cent return the same return as Investor B who was taxed on 100 per cent of her capital gains. Kim thanks for being with us.

Pay the 50 on your gains. January 1 2022 marks the 50th anniversary of the capital gains tax in Canada.

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Crypto Taxation In Canada 2022 Ultimate Guide Ocryptocanada

Taxation Of Investment Income Within A Corporation Manulife Investment Management

2022 Capital Gains Tax Rates In Europe Tax Foundation

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Capital Gains Tax In Canada Explained

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips